2019 marked the third year since the creation of our Employee Stock Ownership Plan (ESOP). For those of you that were eligible for the 2017 distribution and have qualified for each of the subsequent years, you have had three (3) contributions to your stock account...

1. Introducing Our ESOP Educational Series

1. Introducing Our ESOP Educational Series

2019 marked the third year since the creation of our Employee Stock Ownership Plan (ESOP). For those of you that were eligible for the 2017 distribution and have qualified for each of the subsequent years, you have had three (3) contributions to your stock account made on your behalf by the Company. All 2019 or prior eligible participants should have received your latest statement in June of 2020 showing your 2019 contribution and statement of value.

We are proud to be employee owned and want to make sure you see both the value Tanimura & Antle sees in its employees and the value in your individual accounts.

Over the next 5 weeks, you’ll learn about ESOP topics such as:

- What an ESOP is and how it works

- Who is eligible for the ESOP and what a plan year is

- What vesting means and how distributions work

- What employer contributions and valuations mean for ESOPs

- How to understand your annual statements

Common ESOP Terms You Will See Over the Next Few Weeks:

Trustee – The person who represents our shareholders (our employee-owners), votes for the Board of Directors on behalf of the employees and has a responsibility to protect the value of our ESOP shares for our employees.

Eligibility – The requirements that must be met to be eligible to participate in the ESOP and qualify for participation in each plan year.

Plan Year – The twelve month period ending December 31st each year

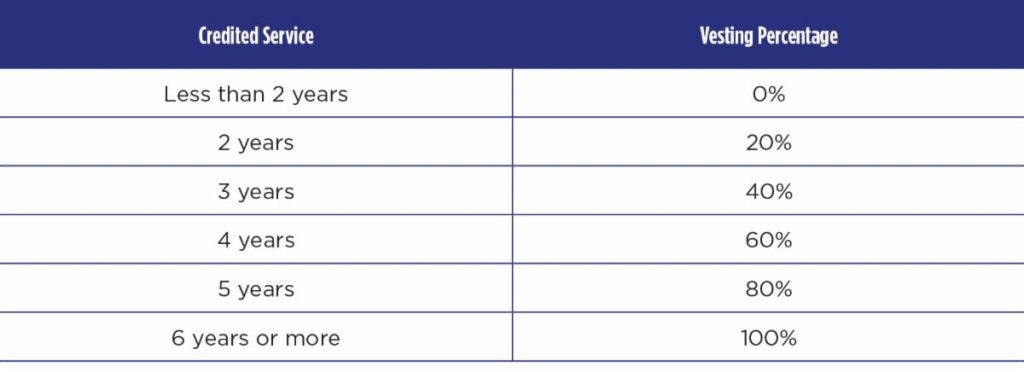

Vesting – The process of earning an increasing percentage of your company stock in your ESOP account through years of service.

Valuation – The process which determines how much our company stock is worth. Each year, an independent appraiser researches our business, industry and financial position to determine our stock value.

Allocation – When and how the Company’s annual contribution to the ESOP is distributed to eligible employees as ESOP shares (company stocks).

We look forward to providing an overview of employee ownership and the ESOP over the coming weeks. Next week, we will be giving you an overview on what an ESOP is, how it works, and why the Tanimura and Antle families decided to offer an ESOP program. Stay tuned!

1. Introducing Our ESOP Educational Series

2. Basics of an Employee Stock Ownership Plan (ESOP)

Hello employee owners! The first topic of our ESOP educational series will be Basics of an Employee Stock Ownership Plan (ESOP). Today’s communication will cover what an ESOP is, how an ESOP works and why the Tanimura and Antle families decided to become an ESOP in...

3. Participants & Plan Year Eligibility

Employees must meet certain requirements to qualify for our Employee Stock Ownership Plan (ESOP). This week, we will be covering what requirements employees must meet to participate in our ESOP. U.S. domestic employees become eligible on the first day of the Plan Year...

4. All About ESOP Vesting

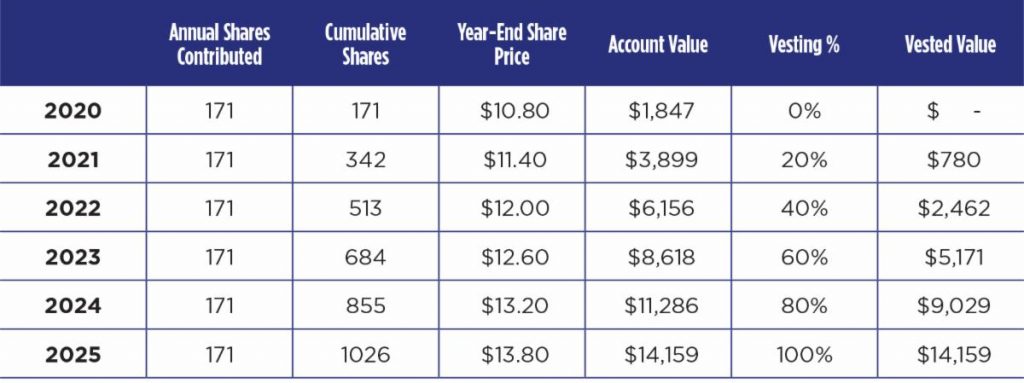

In our first few communications, we learned about the Basics of an ESOP and Eligibility. This week, we will be learning about Vesting. The Company highly values its employees and their choice to invest their time and effort as part of the Tanimura & Antle...

5. Employer Contributions & Valuation

You’re eligible for the Employee Stock Ownership Plan (ESOP) and your account is growing year after year. But how do you gain more shares of stock and how do those shares increase (or decrease) in value? This week, we will learn more about how Tanimura & Antle...

6. Understanding Your Annual Statement

Once a year, you will receive a statement that provides you with an update on your Employee Stock Ownership Plan (ESOP) account. The statement will include information on your total number of Company shares, our new Value Per Share, your Total Account Balance, your...