6. Understanding Your Annual Statement

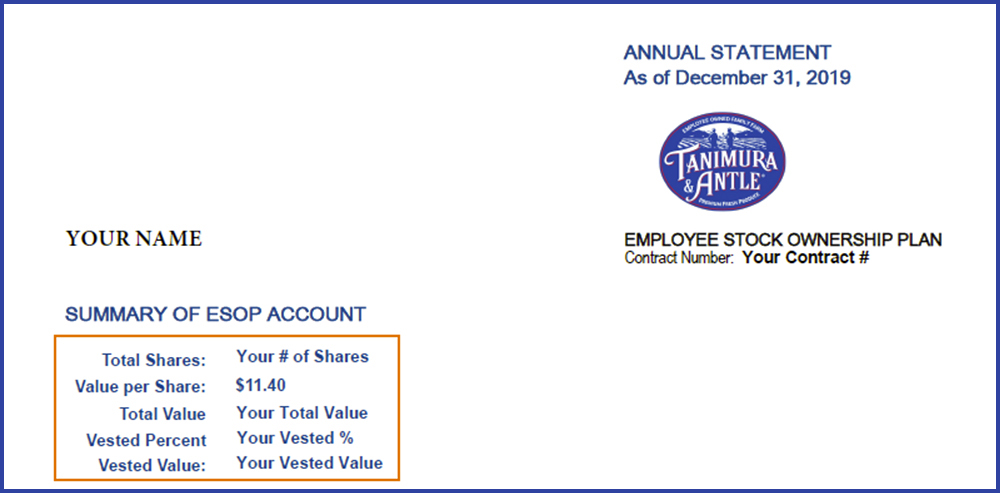

Once a year, you will receive a statement that provides you with an update on your Employee Stock Ownership Plan (ESOP) account. The statement will include information on your total number of Company shares, our new Value Per Share, your Total Account Balance, your Vested Percent, and your Vested Value. The annual statement will also outline your prior Account Balance, your Additions, Change in Account Value (based off an increase or decrease in share value), your Share in the Annual Contribution, and your new Ending Balance as of the end of that plan year (ending December 31).

This top portion of your statement provides you with a summary for the year. Total shares are the number of shares you now hold after the allocation in your account. The value per share is our new Company share value based upon the current valuation (see the communication Employer Contributions & Valuation for reference). The Total Value is the total value of the shares in your account. Next, your Vested Percentage reflects where you stand on the vesting schedule based on your years of service. Your Vested Value is the current total value of the stocks you own. As a reminder, you become fully vested after six years of Credited Service (see the communication Vesting for a reference).

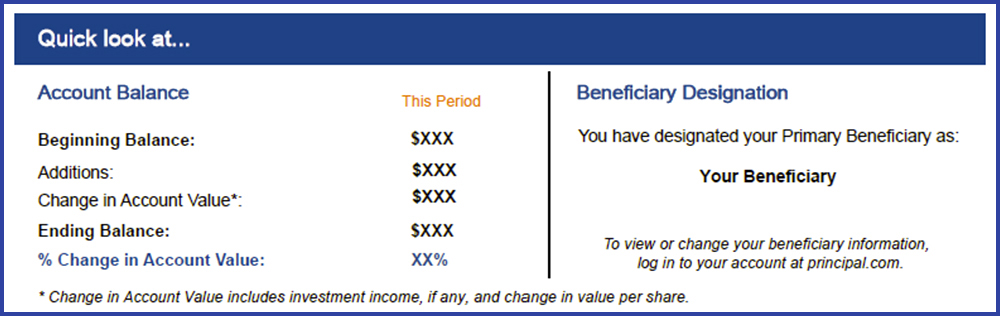

The next section of your statement provides additional details for your Account Balance found in the Summary of ESOP Account. Here you can see your account’s beginning balance from the previous year and the ending balance. The Account Balance reflects the beginning balance, the additions of your new allocation, and Change in Account Value (gains or losses from the change in annual share value in the Company). Here you can also find the percentage that your account changed in the plan year.

Employees are able to designate a beneficiary for their ESOP account; in this section you can also review who is currently listed as your beneficiary. Contact human resources if you need to make a change or addition.

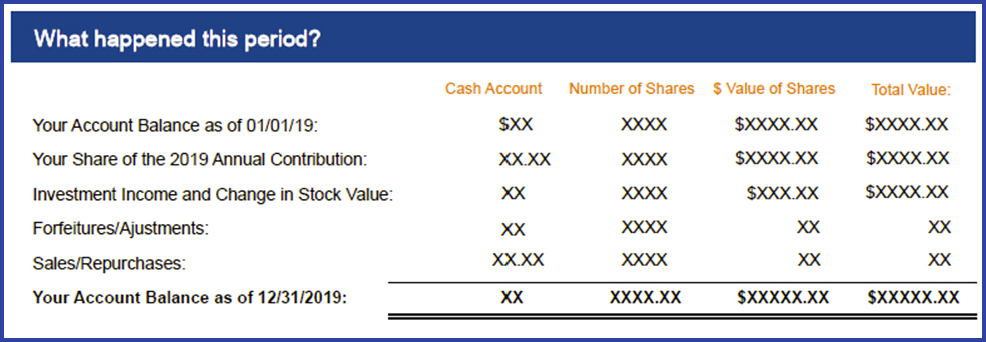

The next section of your statement provides a more in-depth look at your account. Here you can see the detailed activity of your account, including the cash balance, the number of shares, value of shares, and total value of your Account Balance. Your total account value is calculated by adding your cash account to your value of shares.

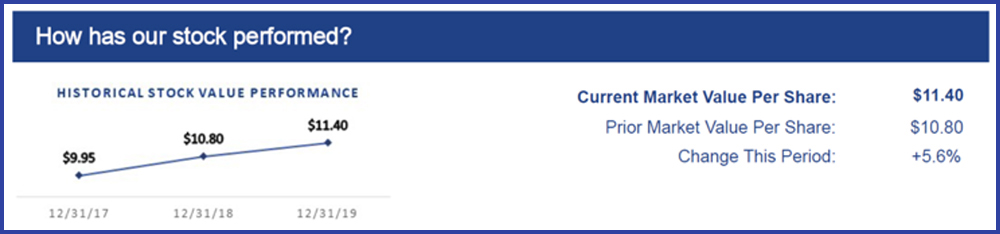

The last section of your statement shows the performance of our stock over time. It also calculates the percent change of the stock over the prior plan year. Like we discussed in earlier communications, the value of the stock will increase and decrease from year to year just like a company’s stock found on the stock market. The difference regarding the share price is that the ESOP stock is valued once per year versus daily in stocks like Apple, IBM or Netflix.

1. Introducing Our ESOP Educational Series

2019 marked the third year since the creation of our Employee Stock Ownership Plan (ESOP). For those of you that were eligible for the 2017 distribution and have qualified for each of the subsequent years, you have had three (3) contributions to your stock account...

2. Basics of an Employee Stock Ownership Plan (ESOP)

Hello employee owners! The first topic of our ESOP educational series will be Basics of an Employee Stock Ownership Plan (ESOP). Today’s communication will cover what an ESOP is, how an ESOP works and why the Tanimura and Antle families decided to become an ESOP in...

3. Participants & Plan Year Eligibility

Employees must meet certain requirements to qualify for our Employee Stock Ownership Plan (ESOP). This week, we will be covering what requirements employees must meet to participate in our ESOP. U.S. domestic employees become eligible on the first day of the Plan Year...

4. All About ESOP Vesting

In our first few communications, we learned about the Basics of an ESOP and Eligibility. This week, we will be learning about Vesting. The Company highly values its employees and their choice to invest their time and effort as part of the Tanimura & Antle...

5. Employer Contributions & Valuation

You’re eligible for the Employee Stock Ownership Plan (ESOP) and your account is growing year after year. But how do you gain more shares of stock and how do those shares increase (or decrease) in value? This week, we will learn more about how Tanimura & Antle...